So which one’s right for you? There’s no easy answer, and there are many factors to consider.

#Residual value of a car plus

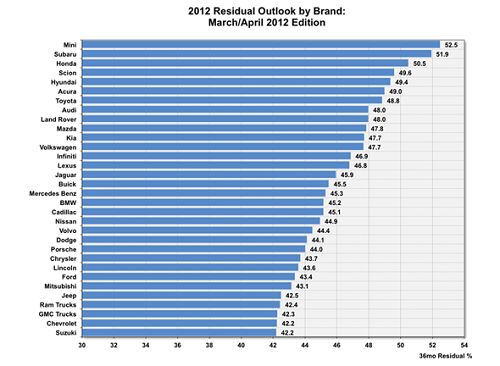

If after three years and 72,000 km, the car you’re leasing has a residual value of 50 per cent of its purchase price, then guess what? You’re paying for the other 50 per cent over the three-year lease term, plus taxes, interest, and other fees. After all, lease payments are little more than usage fees, and you’re paying for that privilege, along with the wear and tear you’re putting on the vehicle. Whether leasing a new vehicle or buying a used one, residual values have a direct impact on pricing.

#Residual value of a car full

Basically, expect to pay close to full pop for something like a Subaru, which limits its incentives, but do so with comfort in the knowledge that it’ll be worth a good percentage of the purchase price when it comes time to sell. In short, incentives upfront devalue a vehicle down the road.īrands that leave less cash on the hood – industry parlance for incentives – do so in part to protect the resale values of their vehicles. The steep discounts Kia offers on its new cars and SUVs may be attractive, but they’ll be felt on the back end when it comes time to sell – or, worse still, when your vehicle is worth less than what’s outstanding on a prolonged finance term. Kia is a fine example of what you can expect in the long term from a highly incentivized vehicle. It could, however, have an indirect effect when it comes to incentives. After all, automakers aren’t charging more for their vehicles based on the estimation that it’s going to be worth more than the competition. If you’re planning to finance or purchase your next vehicle, then resale value won’t exactly have a direct impact on how much you’re going to pay. Companies like ALG earn their keep by providing these insights to automakers and financial institutions for each and every new vehicle on the market. Residual value is estimated at the time a lease is written based on a couple of factors, including historical resale value data and comparative analysis of the vehicle being leased. On top of the interest tacked onto your lease payments, the bank wants to know how much the vehicle will be worth once you’re done with it because the less it’s worth, the more you’ll pay to drive it during your lease period. The bank that holds your lease isn’t doing it as a favour to you, it’s doing it because there’s money to be made. Residual values are akin to educated guesses – and there’s a lot riding on these predictions. See that ad offering thousands of dollars off the purchase price of a new vehicle? That’s going to have a direct effect on how much it’s worth when it’s time to sell. While most of those factors are subject to shift – often from vehicle to vehicle, in the case of condition and mileage – the damage done by incentives is decided ahead of time. Mileage, condition, depreciation, and demand all impact how much a vehicle is worth when it comes time to sell, as will any incentives or rebates applied to the initial purchase price. While there is a certain amount of projection done in advance, resale values are prone to change with the tides of the market.

But the biggest difference between the two is that, while resale value ebbs and flows over time, residual value is locked in ahead of time. They are similar in the sense that the powers that be – automakers, banks and buyers alike – all want to know how much a vehicle will be worth second-hand. Residual values are used to determine how much it costs to lease a vehicle before taxes, interest, and other fees. As the term would suggest, it’s an estimate of the remaining wholesale value of a vehicle after a lease term. Residual value is slightly more complicated, but one way to think of it is as resale value, but for leased vehicles. Purchasing or financing a new car? You’ll probably be keen to know how much the professionals figure it’ll be worth – especially if you’re only planning to keep it for a few years. Resale value is the more self-evident of the pair – it’s how much a vehicle will be worth over time, and is applicable to all types of transactions. While similar, they do have some fundamental differences, and which one you should familiarize yourself with depends on the type of transaction you’re after. Of all the lingo to brush up on before buying or leasing a vehicle, few will impact your purchase quite like resale and residual values. incentives destination and delivery dealer invoice pricing – there’s a lot to learn to make sure you’re getting a fair deal. The auto industry lexicon can often be a labyrinth of perplexing language that is difficult to digest.įrom unintelligible acronyms – MSRP, APR, OAC, PDI, F&I – to confounding phraseology – rebates vs.

0 kommentar(er)

0 kommentar(er)